Understanding how to select kid life insurance is a crucial step for parents looking to safeguard their child’s future. Even though it might not be your first thought, children’s life insurance can offer them financial stability, cover unforeseen costs, and even act as a savings vehicle for the future. However, choosing the best policy can feel difficult due to the abundance of possibilities. Here are five useful suggestions for selecting children’s life insurance that will help you make an informed choice.

Understand Why You Need Life Insurance for Your Child

It’s crucial to comprehend why you could require life insurance for your youngster before looking into products. A child’s life insurance coverage can assist in paying for burial expenses or medical bills in the event of a tragedy, even though nobody likes to consider the unthinkable. Furthermore, some policies accumulate cash value over time, which can be applied to future costs like a down payment on a house or college tuition.

When thinking about how to select children’s life insurance, ask yourself:

Do I want unforeseen events covered?

Do I want a policy that also serves as a tool for saving money?

Is there a medical history in my family that could make it more difficult for my child to obtain insurance in the future?

Understanding your goals will help you narrow down the type of policy that best suits your needs.

Compare Term Life vs. Whole Life Insurance

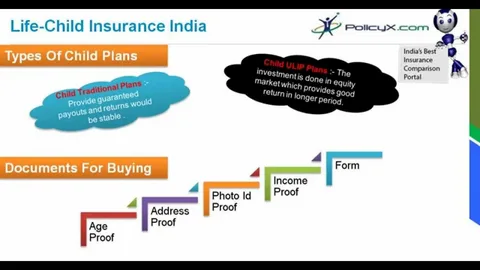

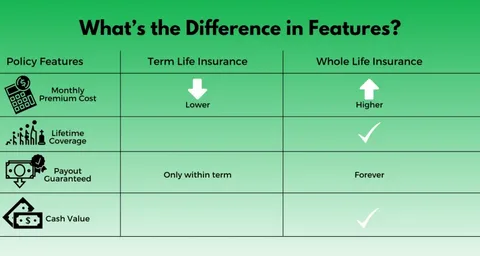

Term life and whole life insurance are the two primary policy kinds you’ll encounter when studying how to select life insurance for kids.

Term life insurance: This kind of policy offers protection for a predetermined amount of time, like 10, 20, or 30 years. Although it doesn’t increase in value, it’s typically less expensive. If your primary goal is temporary coverage, term life insurance is a good choice.

Whole Life Insurance: This type of policy has a savings component that increases over time and provides lifetime coverage. Even though the cost is higher, it can be a long-term financial strategy for your child’s future.

When choosing amongst these solutions, take your long-term objectives and budget into account. To help you balance the advantages and disadvantages, seek advice from a financial counselor if you’re not sure.

Evaluate the Coverage Amount

Choosing the appropriate coverage quantity is another important consideration when selecting life insurance for kids. Even though kids usually don’t require as much coverage as adults do, it’s still crucial to pick a sum that offers sufficient financial security.

Consider:

medical and funeral costs.

Any financial commitments or debts you might have in the case of a disaster.

if you would like a savings component to be included in the insurance for later use.

The majority of kid life insurance plans provide coverage ranging from $10,000 to $50,000. The ideal quantity, however, will be determined by the unique requirements and circumstances of your family.

Research the Insurance Provider

Not all insurance companies are created equal. When figuring out how to choose life insurance for children, take the time to research potential providers. Look for companies with:

- Strong financial ratings (check agencies like A.M. Best or Moody’s).

- Positive customer reviews and a good reputation.

- A history of reliable claims processing.

A reputable provider will give you peace of mind knowing that your child’s policy is in good hands.

Consider the Policy’s Flexibility and Riders

Finally, when deciding how to choose life insurance for children, look for policies that offer flexibility and additional benefits, known as riders. Common riders for child life insurance include:

- Guanteed Insurability Rider: Allows your child to purchase additional coverage in the future without a medical exam.

- Accidental Death Benefit: Provides extra payout if the child’s death is due to an accident.

- Waiver of Premium Rider: Waives premium payments if the policyholder becomes disabled or unable to pay.

These riders can add value to the policy and ensure it grows with your child’s needs.

FAQs

Why should I consider life insurance for my child?

Life insurance for children can provide financial protection in case of unexpected events and serve as a savings tool for their future.

What’s the difference between term and whole life insurance for children?

Term life offers temporary coverage, while whole life provides lifelong protection with a cash value component.

How much coverage do I need for my child?

Most parents choose coverage between 10,000and10,000and50,000, depending on their financial goals and needs.

Can my child use the policy later in life?

Yes, some policies allow children to convert or expand their coverage as adults, often without a medical exam.

Conclusion

A crucial first step in protecting your family’s financial future is understanding how to select life insurance for kids. You may make an informed choice by knowing your needs, comparing different policy types, assessing coverage amounts, investigating providers, and taking into account additional riders. Even though nobody like considering the worst-case situation, having a plan in place can offer financial security and peace of mind for years to come.

Keep in mind that the secret to selecting life insurance for kids is striking a balance between cost, coverage, and long-term advantages. Ask questions, take your time, and seek advice from a financial expert if necessary. The future of your child is worth the work.