Introduction

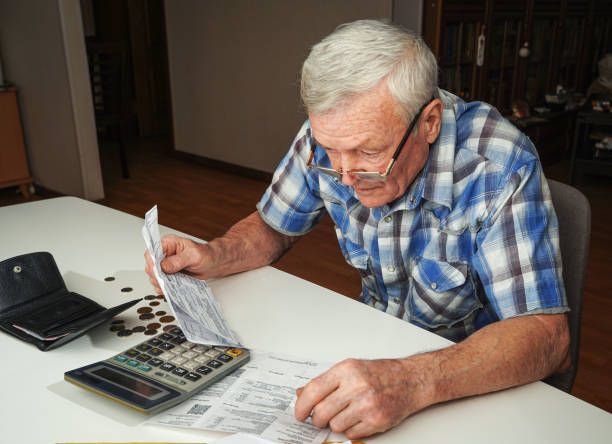

Financial preparation becomes even more crucial as you approach your 60s. The question, “How much life insurance do I need at 60?” is among the most important ones you might encounter.At this point in life, life insurance is more than just a way to replace lost income; it’s also a way to shield your loved ones from financial hardships, pay for final expenses, and leave a lasting legacy. Knowing how much life insurance you need at age 60 is essential, whether your goal is to protect your spouse, provide for your children, or just lessen the financial burden of final expenses.The elements that affect your life insurance requirements, the kinds of plans that are available, and how to choose the best option for your particular circumstance will all be covered in this article. You’ll have the resources to safeguard your family’s financial future at the conclusion, along with a definitive response to the query, “How much life insurance do I need at 60?

The Importance of Life Insurance at Age 60

Younger people with substantial financial obligations and dependents are frequently linked to life insurance. For those in their 60s, it’s equally, if not more, crucial. At this point, you can still be responsible for your dependents, have unpaid bills, or have a mortgage. Funeral expenses can be a major financial hardship for your loved ones, and life insurance can help with that. By posing the question, “How much life insurance do I need at 60?” you are actively working to secure the financial stability of your family.

Factors to Consider When Determining Your Life Insurance Needs

Outstanding Debts:

Your life insurance policy should pay off any outstanding credit card, auto, or mortgage debt. This guarantees that your family won’t have to struggle to settle debts after you pass away.

Final Costs:

Burial and funeral expenses might range from $7,000 to $12,000 or more. Your loved ones can feel more at ease knowing that these costs are covered by your life insurance policy.

Dependents:

Are your spouse, kids, or other dependents financially dependent on you? Determine the amount they would require in order to sustain their level of life.

Healthcare Costs:

Particularly as people age, medical expenditures can mount up. These costs can be partially covered by life insurance.

Legacy Planning:

Take into account your coverage amount if you choose to leave a monetary bequest to your heirs or a nonprofit.

Types of Life Insurance for People Over 60

Term life insurance: Offers protection for a predetermined amount of time, such as ten or twenty years. Although it’s frequently less expensive, people over 60 might not be able to access it.

Whole Life Insurance: Provides cash value together with lifetime coverage. This is a well-liked choice for elderly people seeking long-term security.

Guaranteed Issue Life Insurance:

Promised Problem Life insurance is perfect for people with health concerns because it doesn’t require a medical examination. Nevertheless, coverage quantities are smaller and premiums are greater.

Final Expense Insurance:

Specifically designed to cover funeral and burial costs. It’s a smaller policy but can be a practical choice for seniors

How to Calculate How Much Life Insurance You Need at 60

To determine how much life insurance you need at 60, follow these steps:

Total your outstanding debts, including loans and mortgages.

Compute the costs of your funeral, burial, and medical expenditures.

Determine the financial needs of your dependents, including replacement income and educational expenses.

If you wish to leave a legacy or charitable offerings, mention them.

Deduct any current assets, savings, or any life insurance coverage.

For example, if your debts total 100,000,finalexpensesare100,000,finalexpensesare10,000, and your family needs 200,000tomaintaintheirlifestyle,you’dneedapproximately200,000tomaintaintheirlifestyle,you’dneedapproximately310,000 in life insurance coverage.

Common Mistakes to Avoid When Buying Life Insurance at 60

Underestimating Your Needs: Don’t think that a modest policy will be adequate. Take into account all possible costs.

Ignoring Health Changes: Your eligibility and premiums may be impacted by your health. Tell the truth about your medical background.

Ignoring Policy Riders: Riders can provide your policy important flexibility by offering things like accelerated death benefits or premium waivers.

Not Comparing Quotes: Look around for the greatest deals and possibilities for coverage.

faqs

If I have health problems, can I still buy life insurance at 60?

Yes, people with health concerns can benefit from simplified issue insurance and assured issue policies.

What is the cost of life insurance at age 60?

Your age, health, and level of coverage all affect your premiums. A $100,000 coverage for a healthy 60-year-old can often cost between $100 and $300 each month.

Is term or whole life insurance better at 60?

It depends on your needs. Term life is cheaper but temporary, while whole life offers lifelong coverage with a cash value component.

Conclusion

One of the most important steps in protecting your family’s financial future is figuring out how much life insurance you need at age 60. You can select a policy that offers protection and peace of mind by taking into account your debts, ultimate costs, dependents, and legacy objectives. Whether you choose whole life, term, or final expense insurance, the most important thing is to evaluate your particular needs and compare prices. Keep in mind that protecting your loved ones is something you can do at any time. To start along the path to a more secure future, ask yourself now, “How much life insurance do I need at 60?