introduction

As a parent, you want to give your child the best start in life, and that includes planning for their financial future. One question many parents ask is, “What is the best age to buy life insurance for a child?” The answer is simple: the earlier, the better. In this article, we’ll explore why starting early matters, the benefits of securing life insurance for your child at a young age, and how it can provide lifelong financial security. Whether you’re a new parent or have older children, understanding the best age to buy life insurance for a child can help you make informed decisions for your family.

Why Life Insurance for a Child?

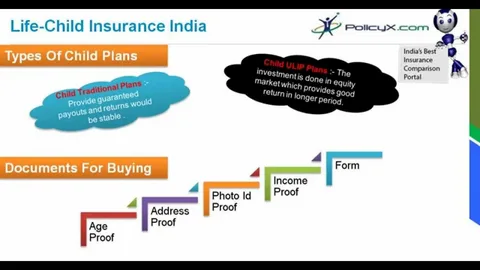

Life insurance isn’t just for adults. While it may seem unusual to consider life insurance for a child, it offers several unique benefits:

- Financial Protection: Covers unexpected expenses, such as medical or funeral costs.

- Guaranteed Insurability: Locks in coverage regardless of future health issues.

- Cash Value Growth: Builds savings over time that can be used for future needs like college or a down payment on a home.

By understanding the best age to buy life insurance for a child, you can maximize these benefits and provide a safety net for your family.

What is the Best Age to Buy Life Insurance for a Child?

The best age to buy life insurance for a child is typically as early as possible, ideally shortly after birth or during infancy. Here’s why:

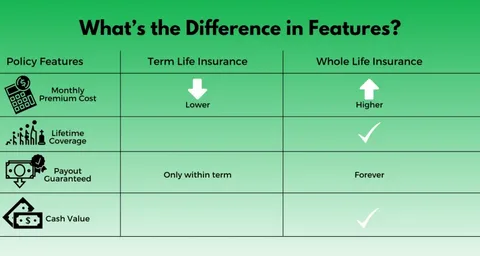

- Lower Premiums: Younger children are healthier, which means lower premiums. The cost of life insurance increases with age, so starting early saves money in the long run.

- Lifetime Coverage: Policies purchased at a young age provide lifelong protection, ensuring your child is covered no matter what happens in the future.

- Cash Value Accumulation: Whole life insurance policies for children build cash value over time, which can be accessed later for major expenses like college tuition or a first car.

- Guaranteed Insurability: Purchasing a policy early ensures your child can’t be denied coverage later in life due to health issues.

Benefits of Buying Life Insurance Early

1. Affordable Premiums

The younger your child is when you purchase a policy, the lower the premiums. For example, a whole life insurance policy for a newborn might cost as little as 5–5–10 per month, while the same policy for a teenager could cost significantly more.

2. Lifelong Financial Security

Starting early ensures your child has coverage for their entire life. This can be especially valuable if they develop health conditions later that would make it difficult or expensive to obtain life insurance.

3. Building Cash Value

Whole life insurance policies for children accumulate cash value over time. This money grows tax-deferred and can be borrowed against for future needs, such as education, a wedding, or even starting a business.

4. Peace of Mind for Parents

Knowing your child is protected financially can provide immense peace of mind. Whether it’s covering unexpected expenses or ensuring their future insurability, life insurance is a gift that keeps on giving.

How to Choose the Right Policy for Your Child

When deciding on the best age to buy life insurance for a child, consider these factors:

- Type of Policy: Whole life insurance is the most common choice for children due to its lifelong coverage and cash value component.

- Coverage Amount: Policies typically range from 5,000to5,000to50,000. Choose an amount that fits your budget and future goals.

- Provider Reputation: Look for a reputable insurance company with strong financial ratings and positive customer reviews.

- Flexibility: Some policies allow you to increase coverage as your child grows, so consider options that offer flexibility.

FAQs About Buying Life Insurance for a Child

1. What is the best age to buy life insurance for a child?

The best age is as early as possible, ideally during infancy, to lock in low premiums and lifelong coverage.

2. Why should I buy life insurance for my child?

It provides financial protection, guarantees future insurability, and builds cash value for future needs.

3. How much does child life insurance cost?

Premiums can start as low as $5 per month, depending on the policy and coverage amount.

4. Can I borrow against my child’s life insurance policy?

Yes, if the policy has a cash value component, you can borrow against it for expenses like college or a car.

Conclusion

When it comes to securing your child’s future, the best age to buy life insurance for a child is as early as possible. Starting young ensures lower premiums, lifelong coverage, and the opportunity to build cash value over time. By understanding the importance of early planning, you can provide your child with financial security and peace of mind for years to come. Remember, the best age to buy life insurance for a child is now—don’t wait to give your child the gift of a protected future.