introduction

When it comes to securing your child’s future, life insurance might not be the first thing that comes to mind. However, child life insurance can be a smart financial decision, offering protection, cash value growth, and peace of mind for parents. In this article, we’ll explore the best child life insurance companies to help you make an informed decision for your family. Whether you’re looking for affordable premiums, lifelong coverage, or additional benefits, these top providers have you covered.

Why Consider Child Life Insurance?

Child life insurance is designed to provide financial protection for your child while also offering long-term benefits. Policies can help cover unexpected expenses, such as medical bills or funeral costs, and some plans even build cash value over time that can be used for future needs like college tuition. By choosing one of the best child life insurance companies, you can ensure your child is protected while also investing in their future.

Top 5 Best Child Life Insurance Companies

Here are the top 5 providers that stand out for their excellent coverage options, affordability, and customer satisfaction:

1. Gerber Life Insurance

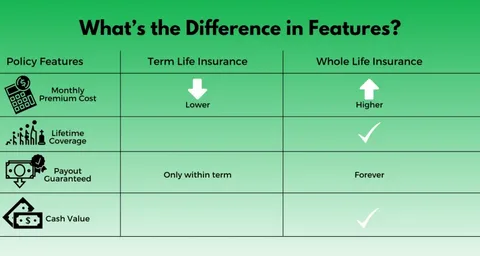

Gerber Life is one of the most well-known names in child life insurance. Their Gerber Grow-Up Plan is a whole life insurance policy designed specifically for children. It offers lifelong coverage, guaranteed insurability, and a cash value component that grows over time.

- Key Features:

- Affordable premiums starting as low as $5 per month.

- Coverage amounts range from 5,000to5,000to50,000.

- Cash value accumulation that can be borrowed against in the future.

- Why Choose Gerber Life?

Gerber Life is a trusted brand with a simple application process and no medical exam required for most policies.

2. Mutual of Omaha

Mutual of Omaha is another top contender among the best child life insurance companies. They offer a Child Whole Life Insurance policy that provides permanent coverage and cash value growth.

- Key Features:

- Coverage amounts from 5,000to5,000to50,000.

- Premiums are locked in and never increase.

- Option to purchase additional coverage as your child grows older.

- Why Choose Mutual of Omaha?

Mutual of Omaha is known for its excellent customer service and flexible policy options.

3. Globe Life

Globe Life is a popular choice for parents seeking affordable and straightforward child life insurance. Their policies are designed to be easy to understand and budget-friendly.

- Key Features:

- No medical exam required.

- Coverage amounts up to $30,000.

- Low monthly premiums starting at just $1.

- Why Choose Globe Life?

Globe Life is ideal for parents looking for no-fuss, affordable coverage with quick approval.

4. State Farm

State Farm is a trusted name in insurance, and their child life insurance options are no exception. They offer a Whole Life Insurance for Children policy that provides lifelong protection and cash value growth.

- Key Features:

- Coverage amounts up to $50,000.

- Premiums are fixed and never increase.

- Option to add additional coverage later in life.

- Why Choose State Farm?

State Farm’s strong reputation and excellent customer service make them a reliable choice for families.

5. Northwestern Mutual

Northwestern Mutual is a top-rated provider known for its financial strength and comprehensive life insurance options. Their Child Protection Plan offers whole life coverage with a cash value component.

- Key Features:

- Coverage amounts up to $50,000.

- Cash value grows over time and can be accessed later.

- Option to convert the policy into a larger one as your child grows.

- Why Choose Northwestern Mutual?

Northwestern Mutual is a great choice for parents looking for a financially stable provider with long-term benefits.

How to Choose the Best Child Life Insurance Company

When selecting a policy for your child, consider the following factors:

- Coverage Amount: Ensure the policy provides enough coverage for your needs.

- Premiums: Look for affordable premiums that fit your budget.

- Cash Value Growth: If building savings is important, choose a policy with a strong cash value component.

- Reputation: Opt for a provider with a strong financial rating and positive customer reviews.

- Flexibility: Consider whether the policy allows for adjustments as your child grows.

FAQs About Child Life Insurance

1. What is child life insurance?

Child life insurance is a policy that provides financial protection for your child and can include a cash value component for future use.

2. Why should I buy life insurance for my child?

It offers financial security, ensures future insurability, and can build cash value for expenses like college.

3. How much does child life insurance cost?

Premiums can start as low as $1 per month, depending on the provider and coverage amount.

4. Can I borrow against my child’s life insurance policy?

Yes, if the policy has a cash value component, you can borrow against it in the future.

Conclusion

Choosing the best child life insurance companies is an important step in securing your child’s financial future. Whether you’re looking for affordable premiums, lifelong coverage, or cash value growth, the providers listed above offer excellent options to meet your needs. By investing in a child life insurance policy, you’re not only protecting your family but also building a foundation for your child’s future. Remember, the best child life insurance companies are those that align with your financial goals and provide peace of mind for years to come.