When planning for your child’s future, two common financial tools often come up: child life insurance and college savings plans. Both serve different purposes, and understanding their benefits, drawbacks, and ideal use cases can help you make an informed decision. This article will compare child life insurance and college savings plans, helping you determine which option aligns best with your family’s goals. We’ll also answer key questions like, What is the best age to buy life insurance for a child?

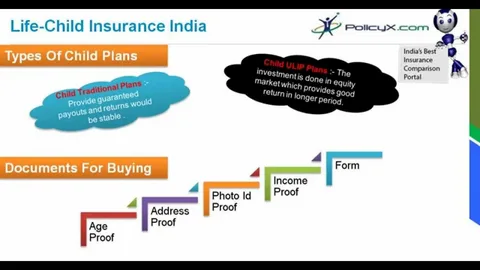

What is Child Life Insurance?

Child life insurance is a policy designed to provide financial protection in the unfortunate event of a child’s death. It typically offers a small death benefit, which can help cover funeral expenses or other costs. Some policies also include a savings component, allowing the policy to accumulate cash value over time.

Pros of Child Life Insurance

- Financial Protection: Provides peace of mind by covering unexpected expenses.

- Cash Value Growth: Some policies build cash value that can be borrowed against later.

- Locked-In Rates: Premiums are often lower when purchased at a young age.

Cons of Child Life Insurance

- Limited Coverage: The death benefit is usually small.

- Not a Primary Savings Tool: It’s not designed to fund major expenses like college.

- Opportunity Cost: Premiums could be invested elsewhere for higher returns.

What is a College Savings Plan?

A college savings plan, such as a 529 plan, is a tax-advantaged account designed to help families save for future education expenses. Contributions grow tax-free, and withdrawals are tax-free when used for qualified educational expenses like tuition, books, and room and board.

Pros of College Savings Plans

- Tax Benefits: Earnings grow tax-free, and withdrawals are tax-free for education.

- Flexibility: Funds can be used for a wide range of educational expenses.

- High Contribution Limits: Allows for significant savings over time.

Cons of College Savings Plans

- Penalties for Non-Educational Use: Withdrawals for non-qualified expenses may incur taxes and penalties.

- Market Risk: Investments are subject to market fluctuations.

- Limited Use: Funds are primarily for education-related costs.

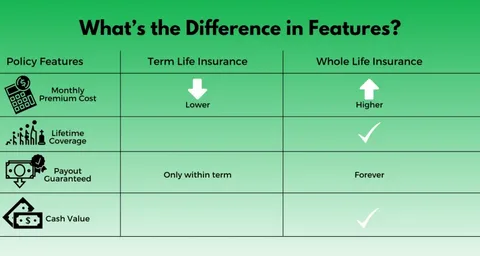

Child Life Insurance vs College Savings Plan: Key Differences

| Feature | Child Life Insurance | College Savings Plan |

|---|---|---|

| Purpose | Financial protection for untimely death | Saving for education expenses |

| Tax Benefits | Limited | Significant tax advantages |

| Cash Value | Possible with certain policies | No cash value, but tax-free growth |

| Flexibility | Limited to death benefit or loans | Flexible for education expenses |

| Risk | Low risk | Subject to market risk |

Best Age to Buy Life Insurance for a Child

The best age to buy life insurance for a child is typically when they are young, often between infancy and early childhood. Purchasing a policy early locks in lower premiums and ensures coverage is in place. However, life insurance for children is not always necessary unless you have specific financial concerns or want to secure their insurability for the future.

Which Option is Right for You?

Choosing between child life insurance and a college savings plan depends on your family’s priorities:

- If your primary goal is to save for education, a college savings plan is the better choice.

- If you want to provide financial protection and potentially build cash value, child life insurance may be worth considering.

For many families, a combination of both can provide a balanced approach to securing their child’s future.

FAQs

1. What is the best age to buy life insurance for a child?

The best age is typically when the child is young, as premiums are lower and coverage is easier to secure.

2. Can I use child life insurance to pay for college?

While some policies have a cash value component, it’s not designed for college funding and may not provide sufficient funds.

3. Are college savings plans only for college?

No, 529 plans can also be used for K-12 tuition, apprenticeships, and student loan repayments.

4. Is child life insurance worth it?

It depends on your financial goals; it’s more about protection than investment.

5. Can I lose money in a college savings plan?

Yes, if the market performs poorly, but long-term growth is generally expected.

Conclusion

When comparing child life insurance vs college savings plans, it’s clear that each serves a unique purpose. Child life insurance offers financial protection and potential cash value growth, while college savings plans provide a tax-advantaged way to save for education. The best age to buy life insurance for a child is typically when they are young, but it’s essential to evaluate whether this aligns with your family’s needs.

Ultimately, the decision depends on your financial goals and priorities. For many families, a combination of both child life insurance and a college savings plan can offer the best of both worlds—protection and growth. By understanding the differences and benefits of each, you can make an informed choice that sets your child up for a secure and successful future.