introduction

When it comes to securing your family’s future, child life insurance is often an overlooked but valuable tool. While no one likes to think about the unthinkable, planning for the unexpected can provide peace of mind and long-term financial security. The benefits of child life insurance extend beyond just covering funeral expenses—it can also serve as a financial safety net, a savings tool, and even a way to lock in insurability for your child’s future. In this article, we’ll explore the key benefits of child life insurance and why it might be a smart choice for your family.

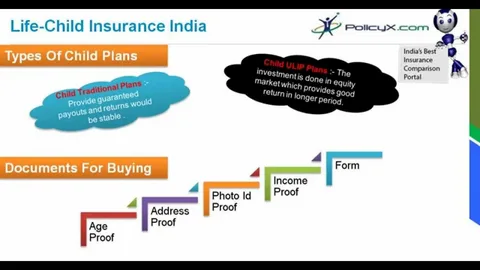

What is Child Life Insurance?

Child life insurance is a type of life insurance policy designed specifically for children. It provides a death benefit in the unfortunate event of a child’s passing, but it also often includes a savings or investment component that can grow over time. Unlike adult life insurance, which is primarily focused on income replacement, child life insurance is more about providing financial protection and future opportunities.

Key Benefits of Child Life Insurance

1. Financial Protection for Unexpected Tragedies

One of the most significant benefits of child life insurance is the financial protection it offers in the event of a tragedy. While no amount of money can replace the loss of a child, having a policy in place can help cover funeral expenses, medical bills, and other associated costs. This ensures that families are not burdened with financial stress during an already difficult time.

2. Locking in Insurability for the Future

Another major advantage of child life insurance is that it guarantees your child’s insurability later in life. If your child develops a health condition in the future, they may struggle to qualify for life insurance as an adult. By purchasing a policy now, you ensure they have coverage regardless of their future health.

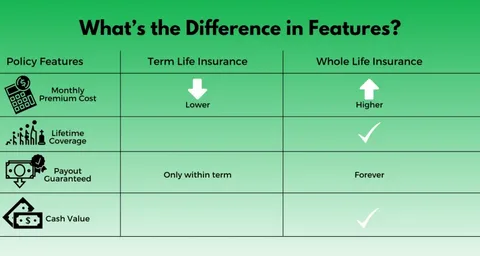

3. Building Cash Value Over Time

Many child life insurance policies come with a cash value component. This means that a portion of the premiums you pay grows over time, creating a savings fund that your child can access later in life. This cash value can be used for college tuition, a down payment on a home, or even starting a business.

4. Affordable Premiums for Long-Term Coverage

Child life insurance policies are typically very affordable, with low premiums that can be locked in for the duration of the policy. This makes it an accessible option for families looking to provide long-term security for their children without breaking the bank.

5. Teaching Financial Responsibility

A child life insurance policy can also serve as a valuable tool for teaching your child about financial responsibility. As they grow older, you can involve them in managing the policy, helping them understand the importance of planning for the future.

Why Child Life Insurance is a Smart Choice

The benefits of child life insurance make it a smart choice for families who want to protect their children’s future. It’s not just about preparing for the worst—it’s also about creating opportunities for your child to thrive. Whether it’s ensuring they have access to affordable insurance as an adult or providing them with a financial safety net, child life insurance offers a range of advantages that can benefit your family for years to come.

Common Misconceptions About Child Life Insurance

1. “It’s Too Expensive”

Many parents assume that child life insurance is costly, but in reality, premiums are often very affordable. For just a few dollars a month, you can secure a policy that provides significant financial protection.

2. “My Child Doesn’t Need Life Insurance”

While it’s true that children don’t have dependents or income to replace, the benefits of child life insurance go beyond just death benefits. It’s about securing their future insurability and building a financial foundation.

3. “I Can Just Save Money Instead”

While saving money is always a good idea, a child life insurance policy offers unique advantages, such as guaranteed insurability and tax-deferred cash value growth, that a regular savings account cannot provide.

FAQs About Child Life Insurance

1. What is the best age to buy child life insurance?

The best age to buy child life insurance is as early as possible, as premiums are lower and you can lock in coverage before any health issues arise.

2. Can my child use the cash value later in life?

Yes, the cash value in a child life insurance policy can be accessed for major expenses like college tuition or a home purchase.

3. Is child life insurance worth it if I already have savings?

Yes, child life insurance offers additional benefits like guaranteed insurability and tax-deferred growth that savings alone cannot provide.

4. What happens to the policy when my child becomes an adult?

When your child becomes an adult, they can take over the policy, convert it to a permanent policy, or use the cash value for their needs.

Conclusion

The benefits of child life insurance are clear: it provides financial protection, guarantees future insurability, and offers a savings component that can grow over time. By investing in a child life insurance policy, you’re not just preparing for the unexpected—you’re also creating opportunities for your child to thrive in the future. Whether it’s covering funeral expenses, building cash value, or teaching financial responsibility, the benefits of child life insurance make it a valuable tool for long-term security.

If you’re considering child life insurance, take the time to explore your options and choose a policy that aligns with your family’s needs. The peace of mind and financial security it provides are well worth the investment.