Your goal as a parent is to give your child the best life possible, now, tomorrow, and forever. Even though it might not be your first thought, kid life insurance is an effective way to protect your family’s future and provide them peace of mind. In this post, we’ll examine the advantages of purchasing life insurance for kids and offer helpful advice to help you make the right choice.

Why Life Insurance for Children?

Children’s life insurance is about more than just planning for the unimaginable; it’s about establishing a safety net and laying the groundwork for their future. Having a policy in place can assist cover unforeseen expenses like funeral fees or hospital bills, even though nobody likes to think about the worst-case scenario. In addition, some life insurance policies have the potential to increase in value over time, providing your child with a future source of funds for things like college, a car, or even a down payment on a house.

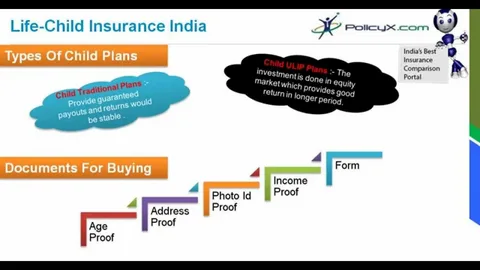

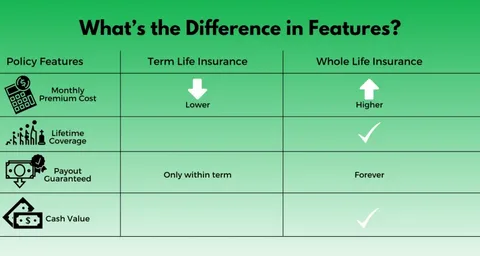

Understanding the two primary policy types—term life insurance and permanent life insurance—is crucial when deciding which life insurance policy is best for kids. While permanent life insurance, like whole life insurance, covers protection for the rest of one’s life and has a cash value component, term life insurance only offers coverage for a set amount of time.

How to Choose Life Insurance for Children: A Step-by-Step Guide

Establish Your Objectives

Ask yourself why you are thinking about getting your child life insurance before you start looking at coverage. Do you want a policy that also serves as a long-term investment, or are you merely seeking cash protection in the event of an unforeseen circumstance? Your choice between term and permanent life insurance will be influenced by your objectives.

Recognize the Different Policy Types for Term Life Insurance:

This is a less expensive choice that offers protection for a predetermined amount of time (for example, 10, 20, or 30 years). Although less prevalent in youngsters, it might be appropriate for certain situations.

Permanent life insurance: This kind provides coverage for the rest of one’s life and gradually increases in value. It is a well-liked option for parents who wish to combine savings with protection.

Choose the Appropriate Level of Coverage

Think about the amount of coverage you require when selecting life insurance for kids. Children’s insurance policies usually provide smaller coverage amounts (e.g., 25

000 to 25,000 to 50,000), since the main objective is to pay for last-minute costs rather than to replace revenue.

Seek for additional benefits and riders.

Optional riders, including critical illness coverage or the option to buy more coverage in the future, are included in many policies. The value and adaptability of the policy can be improved by these additions.

Select a Reputable Insurance Company

Pick a business that has a solid track record of satisfied customers and high financial ratings. A trustworthy supplier guarantees the security of your policy and the prompt processing of claims.

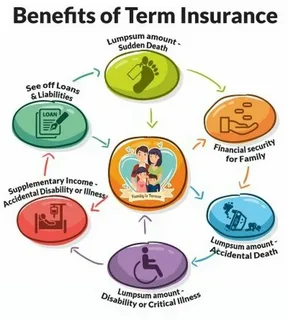

Benefits of Life Insurance for Children

Financial Security: Unexpected costs, including funeral or medical bills, can be partially covered by a life insurance policy.

Cash Value Growth: Over time, permanent life insurance plans build up cash value that can be accessed at a later age.

Locking in Insurability: Getting your child an insurance guarantees that they will be covered even if they experience health problems in the future.

Reasonably priced premiums: Children’s life insurance is typically reasonably priced, particularly when acquired early in life.

Common Mistakes to Avoid

Avoiding these typical errors is crucial when understanding how to select life insurance for kids:

Purchasing Too Much Coverage: Children don’t require as much coverage as adults do. Choose an insurance that best suits your requirements.

Ignoring the Fine Print: Carefully review the policy’s provisions to determine what is and is not covered.

Ignoring Quote Comparison: Compare prices and coverage options to get the best deals.

Tips for Choosing the Right Policy

Start Early: The younger your child is when you purchase a policy, the lower the premiums will be.

Compare Multiple Quotes: Don’t settle for the first policy you find. Shop around to get the best deal.

Work with a Trusted Advisor: An insurance agent or financial planner can help you navigate your options and choose the best policy for your family.

Review the Policy Regularly: As your child grows, their needs may change. Make sure their policy continues to meet your family’s goals.

FAQs

. Is life insurance for children necessary?

Life insurance for children is not mandatory, but it can provide financial protection and peace of mind for parents.

What’s the difference between term and permanent life insurance for kids?

Term life insurance provides coverage for a set period, while permanent life insurance offers lifelong coverage and includes a cash value component.

Can my child use the cash value from a permanent policy?

Yes, the cash value can be accessed later in life for expenses like education or a down payment on a home.

How much does life insurance for children cost?

Premiums are generally affordable, often costing just a few dollars per month, depending on the coverage amount and policy type.

Conclusion

Learning how to choose life insurance for children is an important step in protecting your family’s financial future. By understanding your goals, comparing policy types, and evaluating coverage options, you can make an informed decision that meets your needs. Whether you’re looking for financial protection or a long-term investment, life insurance for your child can offer valuable benefits.

Remember, the key to how to choose life insurance for children is to focus on your family’s unique circumstances and work with a trusted insurance provider. With the right policy in place, you can ensure your child’s future is secure, no matter what life brings.